IRS: Churches & Politics Don't Mix genre: Hip-Gnosis & Polispeak & Six Degrees of Speculation

The IRS has issued a warning to churches that they risk their tax exempt status if they fail to observe the requirement that they not engage in political activities. The 2004 presidential election marked a turning point in churches approaching the line of demarcation as the Catholic Church told its members that they should examine their beliefs before voting for politicians who did not uphold the principles of the Church, especially with regard to supporting the legality of abortions as determined in Roe v. Wade.

Thought Theater recently reported on efforts by the Catholic Church in Colorado to gather petition signatures for a ballot initiative to ban same sex marriage here. To read the full article on the IRS warning, the LA Times has the article here.

The Internal Revenue Service is warning churches and nonprofits that improper campaigning in the upcoming political season could endanger their tax-exempt status.

The agency also launched a program to expedite investigations into claims of improper campaigning, prompting an advocacy group to charge this month that the program could restrict the free speech of nonprofit groups and churches.

Under the program, the IRS will no longer wait for an annual tax return to be filed or the tax year to end before investigating allegations of wrongful campaigning. A three-member committee will make an initial review of complaints and then vote on whether to pursue the investigation in detail.

"While the vast majority of charities and churches do not engage in politicking, an increasing number did take part in prohibited activities in the 2004 election cycle," IRS Commissioner Mark W. Everson said in a statement. "The rule against political campaign intervention by charities and churches is long established. We are stepping up our efforts to enforce it."

The code bans nonprofits from "participating or intervening" for "any candidate for public office." That includes endorsements, donations and fundraising. But nonprofits are allowed to speak out on issues of public interest as long as "a substantial part of the organization's activities is not intended to influence legislation."

Many tax exempt organizations have argued that the guidelines are quite vague which makes it difficult for organizations to determine the limitations thereby forcing undue caution. In my opinion, the added caution the warnings may create would provide a much needed deterrent to the ever expanding efforts of tax exempt organizations to skirt the regulations and influence the voting decisions of their memberships.

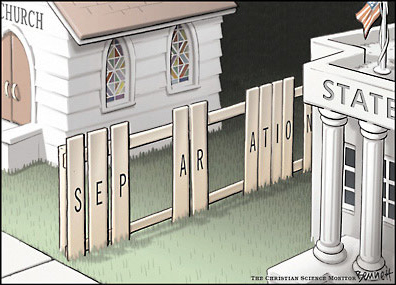

The tenor of the Republican Party in the last decade has simply emboldened many to blur the lines that require the clear separation of church and state. I am pleased to see at least one government agency reminding us of that distinction. I'm hopeful others will follow.

Post a comment