Housing Market Continues To Threaten Economy genre: Econ-Recon

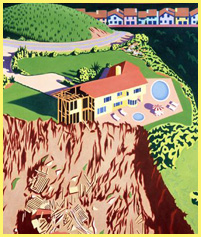

While a number of economists have suggested that the impact of the slow housing market may have already been felt and that the worst is over, the recent data may argue otherwise. Home sales fell to their lowest level in four years and prices dropped for the tenth straight month. Factor in foreclosure rates and the large numbers of sub-prime loans still at risk and it may be too early to conclude that the economy is out of the woods.

The National Association of Realtors reported Monday that sales of existing single-family homes and condominiums dropped by 0.3 percent to 5.99 million units in May, the slowest sales pace since June of 2003.

The median price of a home sold last month dropped to $223,700, down 2.1 percent from a year ago. It marked the 10th straight price decline compared with a year ago, the longest stretch of weakness on record.

In a troubling sign for the future, the inventory of unsold homes rose by 5 percent to 4.43 million units in May, a level that would take 8.9 months to clear out at the May sales pace. That is the highest inventory level since the last deep slump in housing in 1992.

The current slump in housing is the worst since the 1989-92 downturn. It is occurring after a prolonged boom that saw sales of new and existing homes set new records for five consecutive years.

The Realtors are predicting that the median home price will decline by 1.3 percent this year while sales are forecast to drop by 4.6 percent. It would be the first annual price decline in four decades of record-keeping.

Another potential problem is mortgage rates, which have been trending higher in recent weeks although they still remain below their historical averages.

In a worst case scenario the Federal Reserve may determine that it must raise interest rates to prevent growing signs of inflation. If that happens, interest rates on mortgages would be forced to return to more conventional levels; causing sales to decline and further driving home prices lower.

If and when that were to happen, one could also expect consumer spending to decline as more homeowners would have less disposable income and borrowing capacity. Foreclosures would likely increase because homeowners with adjustable rate loans would find themselves unable to bear the added expense. Lastly, selling a home would become more difficult since rising interest rates would further reduce the number of qualified buyers.

Perhaps the worst case scenario won’t materialize...but it also seems premature to conclude that the full effect of the housing slump has been felt. I'm of the opinion that we are in uncharted waters and it may not be wise to rely on prior historical assumptions when attempting to weigh the impact of the current housing dilemma.

Post a comment