Inside The Numbers: The Humpty Dumpty Economy? genre: Econ-Recon & Polispeak

We may not be officially in the throes of a recession, but there is sufficient data to understand why voters are focusing their attention on the economy. While economics is thought to be a function of mathematical equations, the evidence suggests that math is driven by consumer sentiment. As such, the math can rarely predict a recession. Instead, as is often the case, understanding a recession frequently happens well after the fact.

I've been amused to watch economists offer their odds on the U.S. slipping into a recession. For example, over the last several months...as the numbers have worsened, former Federal Reserve Chairman, Alan Greenspan, has revised his prediction a from one in three chance to a fifty-fifty likelihood we will see a recession. Greenspan isn't alone in having altered his thinking...and I expect to see more of the same until such time as the math can capture the impact of rapidly expanding consumer pessimism.

Truth be told, December may well prove to have been the first month of a recession. In the constant barrage of numbers and statistics leading up to a recession, we occasionally receive data that captures the prevailing factors that are driving consumer doubts. Today, McClatchy News delivered a relevant snapshot.

WASHINGTON — New data from the Labor Department confirm what most middle-class Americans already know: Inflation is squeezing them.

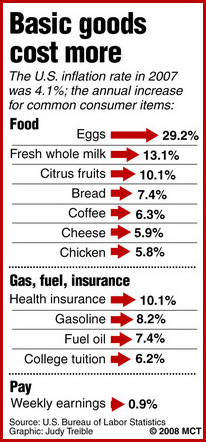

As consumer inflation rose by 4.1 percent last year, the highest rate since 1990, the prices of basic essentials such as food, gasoline and health insurance climbed far more steeply, explaining why so many Americans are telling pollsters that the economy is their chief concern.

The Bureau of Labor Statistics reported Wednesday that the price of food and beverages rose 4.8 percent. At the same time, real weekly earnings failed to keep pace, rising 0.9 percent for the year. In the simplest of terms, a dollar earned bought less.

This partly explains why the economy so frustrates Americans.

"The kinds of things you purchase every day are going up (in price)," said Gus Faucher, the director of macroeconomics at forecaster Moody's Economy.com in West Chester, Pa. "People who are at the lower end of the income scale are going to feel that more."

That brings me to another point. If tax cuts are the be all and end all that the GOP suggests them to be, then why is it that they fail to insulate the middle class from a downturn in the economy? The obvious answer is that aside from being a symbolic gesture to most Americans, the tax cuts are simply a drop in the bucket. At the same time, the lion's share of these tax cuts serve to further line the pockets of those who least need insulating from a faltering economy.

Perhaps the prevailing economic fallacy is the contention that further tax cuts will stimulate the economy. This might be true if the cuts were directed to those most in need of money to spend...the same middle class that pushed the economy into recession based upon their astute ability to recognize that their money buys less.

Instead, the GOP argues that their top-heavy tax cuts will eventually be transformed into investments and jobs. Unfortunately, that strategy fully ignores the fact that people in the middle class need more money; not more jobs. If those who already have jobs...have jobs that won't allow them to keep apace with inflation...then what benefit will they see from the creation of new jobs...especially when most investors and large corporations are looking to create more lower paying jobs in order to produce more wealth. Even worse, globalization often means that these tax cuts are put into foreign investments that do not create jobs for Americans.

Until such time as economic policy is geared to produce meaningful benefit for the middle class, the economy will remain unstable and vulnerable, the handouts to the wealthy will further concentrate wealth in the hands of fewer individuals, and negative consumer sentiment will more frequently send the country into recession.

Lastly, the unprecedented subprime lending crisis...coupled with the inevitable decline in home values...has the potential to indefinitely stymie consumer optimism. Once the undermining of this last bastion of middle class wealth is realized, I would argue that all economic equations would have been rendered useless. If this happens, the backbone of the U.S. economy may be...like the fabled Humpty Dumpty...beyond reconstruction.

Post a comment